Choosing the right health insurance for your employees can be a daunting task, impacting both their well-being and your company's bottom line. In Missoula, Montana, Allegiance Benefit Plan Management (ABPM) offers a solution, promising affordable healthcare without sacrificing quality. But is it the right fit for your business? This article explores ABPM's services, provides a framework for making an informed decision, and offers actionable steps for both employers and employees to optimize their healthcare experience. For more information on Montana health insurance options, check out this helpful resource.

Understanding Allegiance Benefit Plan Management Missoula

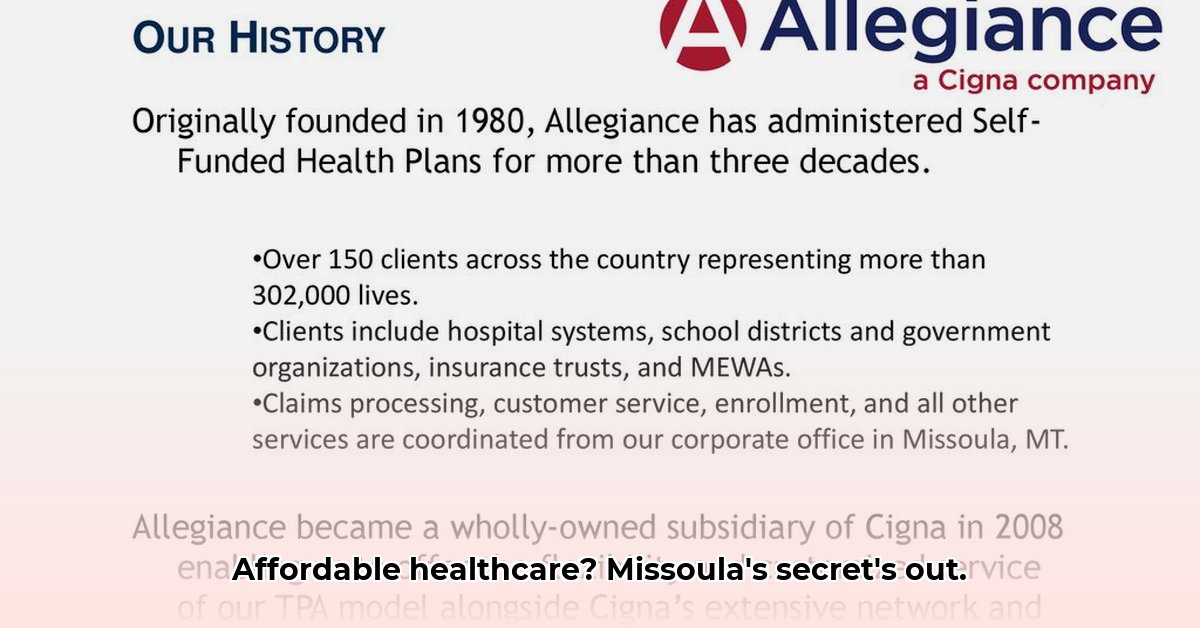

Allegiance Benefit Plan Management has served Missoula businesses since 1981, building a reputation on cost transparency and accessible healthcare. They partner with organizations like Healthcare Bluebook, a tool that allows for easy comparison shopping of medical procedures and services—a significant advantage in navigating the complexities of healthcare costs. This transparency sets them apart in a market often characterized by opaque pricing. Their extensive network of doctors and specialists provides employees with a wide range of choices.

However, a lack of readily available quantitative data regarding cost savings and client numbers presents a challenge in directly comparing them to competitors. This article addresses this information gap by providing a framework for thorough evaluation.

What Allegiance Offers: A Detailed Look

Allegiance aims to provide accessible and affordable healthcare. Their core focus is on comprehensive benefits and cost management. While their website highlights their provider network and commitment to transparency, more detailed information regarding specific plan types, technological infrastructure, and the overall employee experience would benefit potential clients.

For Employers: A Strategic Decision-Making Guide

Considering Allegiance for your business? Follow these steps to ensure a well-informed decision:

- Demand Quantifiable Data: Request concrete data demonstrating return on investment (ROI). Ask for specific examples of cost savings achieved for similar businesses. Real numbers are essential.

- Assess System Integration: Determine how seamlessly Allegiance's system integrates with your existing HR technology. A smooth transition is critical to avoid operational disruptions.

- Conduct Comparative Analysis: Thoroughly compare Allegiance's offerings with those of other providers, considering not only initial costs but also long-term savings and potential flexibility.

For Employees: Maximizing Your Healthcare Benefits

If your employer uses Allegiance, consider these steps to fully utilize your benefits:

- Evaluate User-Friendliness: Assess the ease of accessing benefit information and managing your plan through Allegiance's online portal. A user-friendly system saves time and reduces frustration.

- Understand Plan Options: Ensure you understand the various plan choices, their associated costs, and the specific coverage they provide. Don't hesitate to ask for clarification from your HR department or Allegiance directly.

- Proactive Communication: Open communication is key. Address any questions or concerns promptly with your HR department or Allegiance's customer support team.

Areas for Future Growth: Enhancing Transparency and User Experience

Allegiance could significantly enhance its market position by increasing data transparency. Sharing case studies and quantifiable cost savings would build credibility and attract new clients. Improving the user experience of their online portal and providing more comprehensive resources for employees would also be beneficial. Investing in robust data analysis and reporting would allow them to track key performance indicators (KPIs) such as cost reduction and employee satisfaction, further strengthening their value proposition. Exploring strategic partnerships with telehealth providers or wellness programs could also broaden their appeal.

How to Compare Allegiance Costs with Competitors

Direct cost comparisons are challenging without access to specific plan details. However, a structured approach allows for effective evaluation:

- Define Needs and Budget: Clearly articulate your company's healthcare needs and budget constraints. Consider your employees’ demographics and healthcare utilization patterns.

- Obtain Detailed Proposals: Secure detailed proposals from Allegiance and competitors, including premiums, out-of-pocket maximums, and all relevant cost components.

- Analyze Healthcare Bluebook Integration: Evaluate the depth and effectiveness of Allegiance's Healthcare Bluebook integration, comparing it to the cost transparency offered by competitors.

- Compare Covered Services: Examine the specific services covered by each plan, considering deductibles, co-pays, and other out-of-pocket expenses.

- Evaluate Administrative Support: Compare the breadth of administrative services offered, including COBRA administration and case management.

- Consider Long-Term Costs: Consider long-term cost projections and the flexibility each plan offers. Self-funded options, frequently available through Allegiance, may offer significant cost advantages.

Remember, a successful healthcare strategy involves a partnership, ensuring both employers and employees benefit from a well-structured and transparent plan. By following the steps outlined above, you can effectively evaluate Allegiance Benefit Plan Management and determine if it's the right solution for your unique needs.